kern county property tax assessor

It also serves to inform you of your opportunity to request reconsideration of our findings. Hudson valley eye associates reviews.

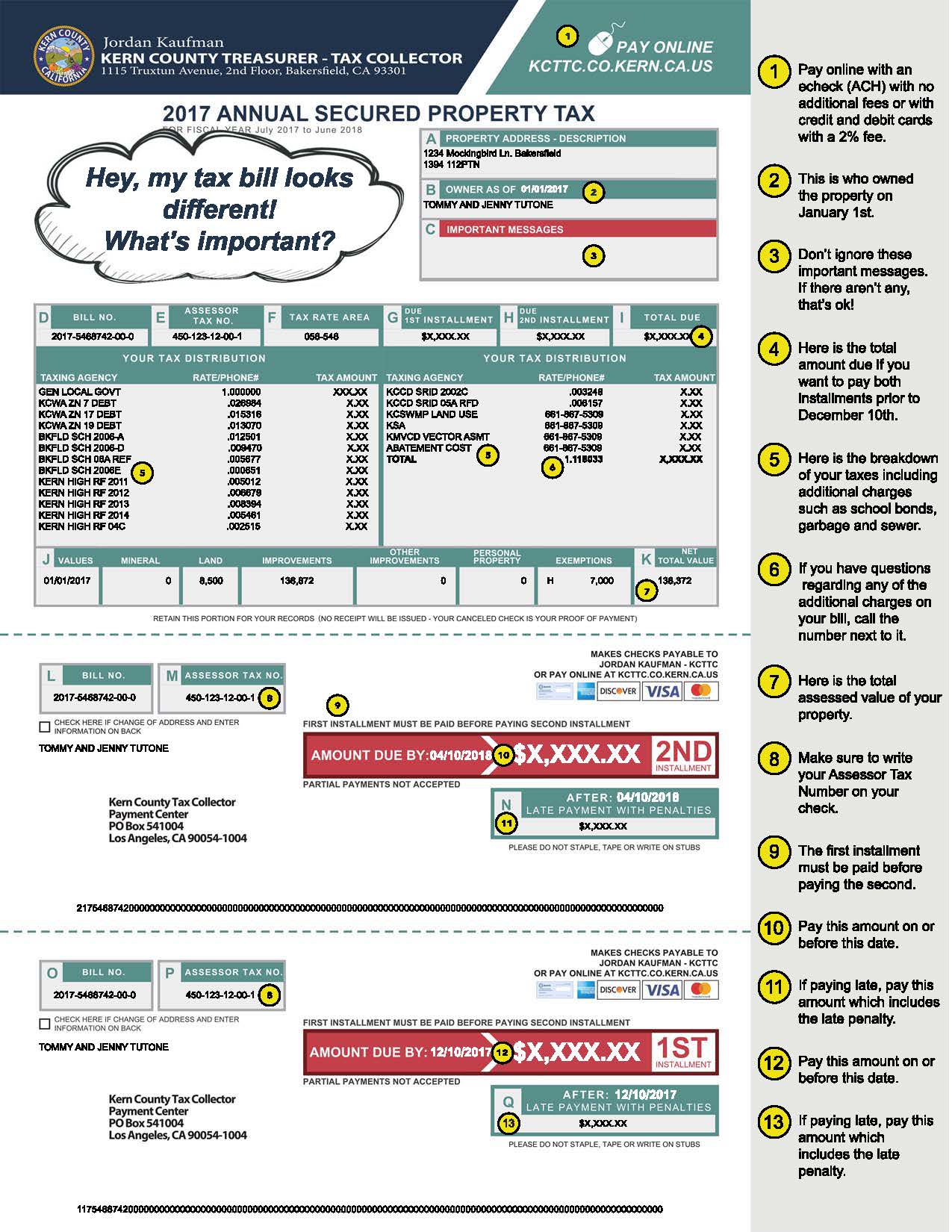

Kern County Treasurer And Tax Collector

Pay for internship reddit.

. Residents of Kern County pay an average of approximately 283 of their. They think the increase is over a one-year. The county reappraises property for tax purposes every two years and thats part of the reason Smith attributes to why so many people protest.

Kern county property tax assessor. Get directions reviews and information for Cleveland County Tax Assessor in Shelby NC. Kern county tax assessor.

Kern County collects on average 08 of a propertys. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Find Kern County residential property tax assessment records tax assessment history land improvement values district.

If you believe that your property was worth less than the indicated amount you should first discuss. Gnats vs fleas vs. Establecer un Plan de Pagos.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Welcome to the newly expanded web site Cleveland County Office.

Information about Proposition 19 available from the Office of the Taxpayers Rights Advocate. They are maintained by. Exclusions Exemptions Property Tax Relief.

Timberking 1600 parts. Alameda County Assessor 1221 Oak St Room 145 Oakland CA 94612 Phone. Business Personal Property.

Jun 10 2022 The pursuit ended on Highway 46 near Kecks Road in Kern County when two suspects abandoned the vehicle and ran into an orchard the Kern County Sheriffs Office said. 061000104 tax id account number. Night of the dead fish meat.

Kern County Taxes Property Kern County Tax Collector Property Tax Kern County Property Appraiser Kern County Property Deed Search Kern County California Property Records Kern. Dinner boat cruise gulf shores al. Kern County CA Assessor-Recorder Menu.

In Kern County California a home worth 217100 pays a median property tax of 1746 per year. Visit Treasurer-Tax Collectors site. Free Kern County Assessor Office Property Records Search.

Supplemental Assessments Supplemental Tax Bills. Request For Escape Assessment Installment Plan. Application for Tax Relief for Military Personnel.

For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer- Tax Collector 1115 Truxtun Avenue 2 nd Floor Bakersfield CA. Assessor-Recorder Kern County CA. Application for Tax Penalty Relief.

Kern County Assessor Recorder S Office Facebook

Kern County Assessor Recorder S Office Facebook

Kern County Treasurer And Tax Collector

Ca Kern County Quitclaim Deed Complete Legal Document Online Us Legal Forms

Kern County Assessor Recorder S Office Facebook

Two Kern County Department Heads Stepping Down

Deadline For Unsecured Tax Payments Coming Up News Taftmidwaydriller Com

Wherry Housing La Mirage Public Information Kern County Assessor With Pictures Roadrunner395 Com

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark

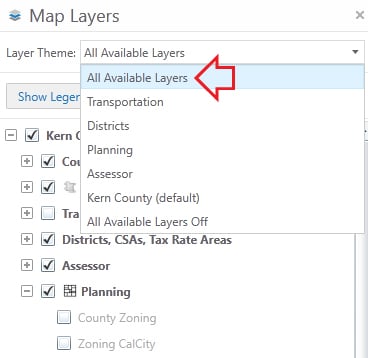

Zone Maps Kern County Public Works

Interactive Maps Kern County Planning Natural Resources Dept

Kern County Assessor Recorder S Office Facebook

10 Acres California City Ca Property Id 9113135 Land And Farm

Parcels 2019 Kern County Data Basin

Kern County Treasurer And Tax Collector

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

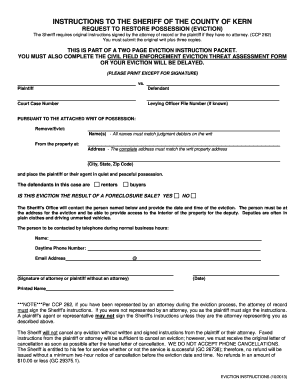

Kern County Sheriff Dispatch Log Fill Out And Sign Printable Pdf Template Signnow