nh food tax rate

Some rates might be different in Portsmouth. Meals and Rooms Tax Where The Money Comers From TransparentNH.

New Hampshire Sales Tax Handbook 2022

On average homeowners in New.

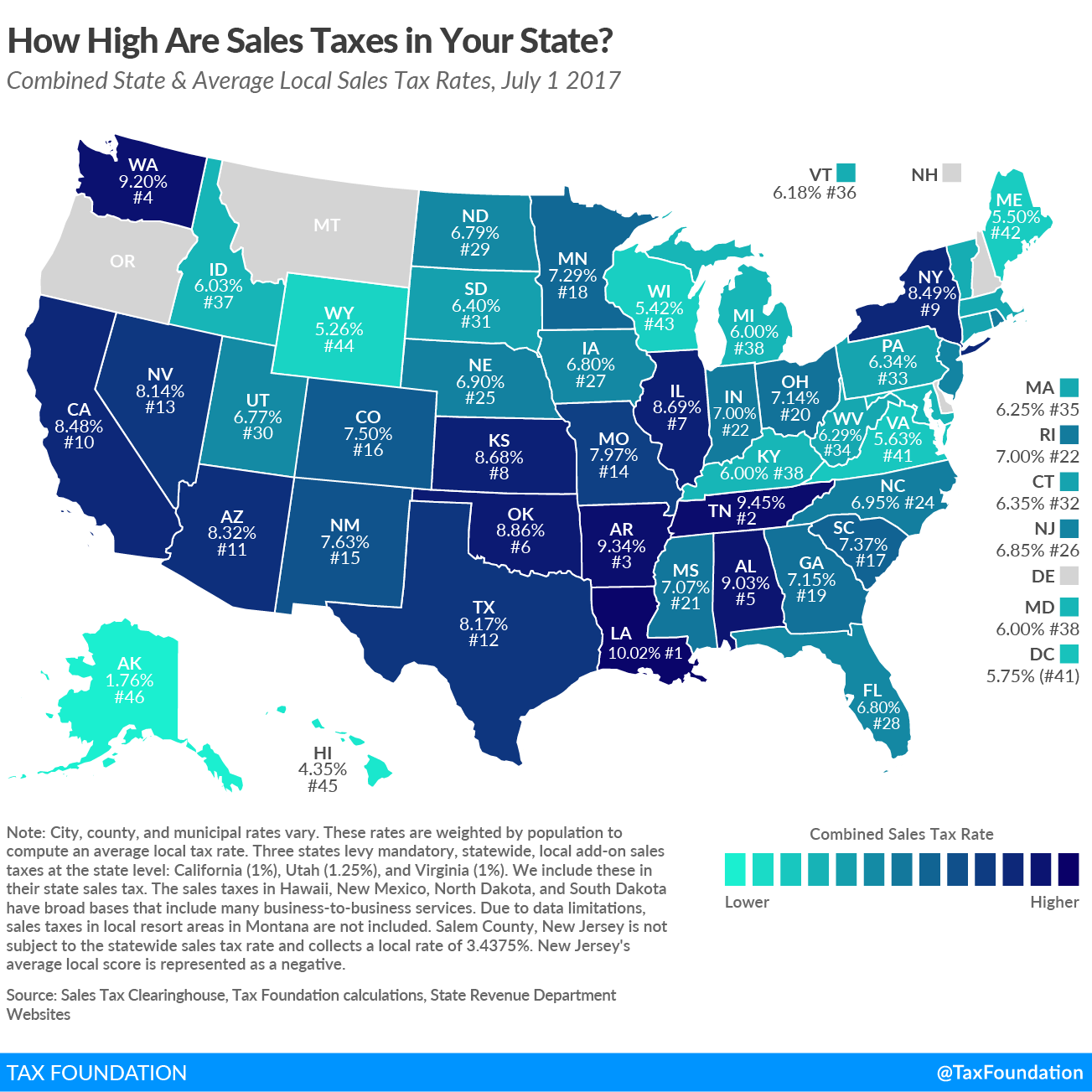

. Capital and debt service are not current. California 1 Utah 125 and Virginia 1. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. Cost Per Pupil By District Cost per Pupil is based on current expenditures as reported on each school districts Annual Financial Report DOE-25.

Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. New Hampshire is one of the few states with no statewide sales tax.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. 2021 2020 2019 2018 2017 2016. The meals and rentals mr tax was enacted in 1967 at a rate of 5.

Employers can view their current and prior quarter tax rates on our WEBTAX System. Nh food tax rate Thursday March 31 2022 Edit. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases.

While the base rate applies statewide its only a starting point for calculating sales tax in New Hampshire. How 2021 sales taxes are calculated in new hampshire. A net rate of 17 is now allocated as 04 AC and 13 UI.

43 rows Annual Tax Rate Determination Letters mailed August 26 2021 for the period 712021 Q32021 through 6302022 Q22022. Food Service guidance issued on May 18 2020. New Hampshire Property Tax.

Official NH DHHS COVID-19 Update 34b. New Hampshire is one of the few states with no statewide sales tax. If you need any assistance please contact us at 1-800-870-0285.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Cost per pupil represents current expenditures less tuition and transportation costs.

2022 New Hampshire Sales Tax Table. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate. Nh food tax rate Friday March 25 2022 Edit.

COVID-19 NH Division of Public Health Services updated December 4 2020. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Car Insurance Rates By State Insure Com Car Insurance Rates Car Insurance Inexpensive Car Insurance A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. A net rate of 17 is now allocated as 04 AC and 13 UI. New Hampshire is one of the five states in the USA that have no state sales tax.

New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. There are however several specific taxes levied on particular services or products.

The state sales tax rate in New Hampshire is 0 but you can customize this table as. The state meals and rooms tax is dropping from 9 to 85. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic.

For additional assistance please call the. Any food service revenue is deducted from current expenditures before dividing by ADM in attendance. Nh food tax rate.

Its a change that was proposed by Gov. Americans Are Migrating To Low Tax States Native American Map United States Map States. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019.

Meals and Rentals TaxRSA Chapter 78-A. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Eqkdqb7mjbevtm to ensure a smooth transition to the new tax rate we are.

A 9 tax is also assessed on motor vehicle rentals. Land Use Department. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting.

Filing options - Granite Tax Connect. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. B Three states levy mandatory statewide local add-on sales taxes.

New Hampshires sales tax rates for commonly exempted categories are listed below. New Hampshire Property Tax. Base state sales tax rate 0.

There are however several specific taxes levied on particular services or products. Prepared Food is subject to special sales tax rates under New Hampshire law. Chris Sununu in this years budget package which passed state government in June.

New Hampshire Property Tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. 2012 Tax Rate School 1397 State 109 Town 335 County 236.

A net rate of 17 is now allocated as 04 AC and 13 UI. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

For additional assistance please call the Department of Revenue Administration at 603 230-5920. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

Understanding New Hampshire Taxes Free State Project

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

States With The Highest And Lowest Property Taxes Property Tax States Tax

How To Charge Your Customers The Correct Sales Tax Rates

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Mark Fernald Why Your Property Taxes Are So High

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

New Hampshire Sales Tax Rate 2022

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

New Hampshire Sales Tax Rate 2022

How Do State And Local Sales Taxes Work Tax Policy Center

New Hampshire Sales Tax Rate 2022